-

×

Solar Wave RK 1 × $374

Solar Wave RK 1 × $374

Are you a new or struggling trader and want to be a professional trader?

If so, we can help you and provide you with the necessary tools for you to succeed in your goals.

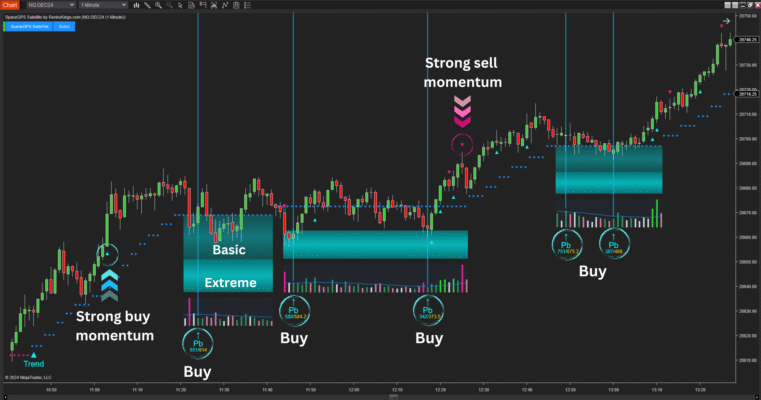

Check out this killer combo on Reko charts 👉 [Sumo Pullback$ + Imbalance Volume Sensor]

🔥 Scalpers, this one’s for you... 🔥

Get your favorite scalping indicators & systems before the deal ends in 2 days!